oregon tax payment deadline

Find approved tax preparation services. Payments with returns due after May 15 2020 are not extended.

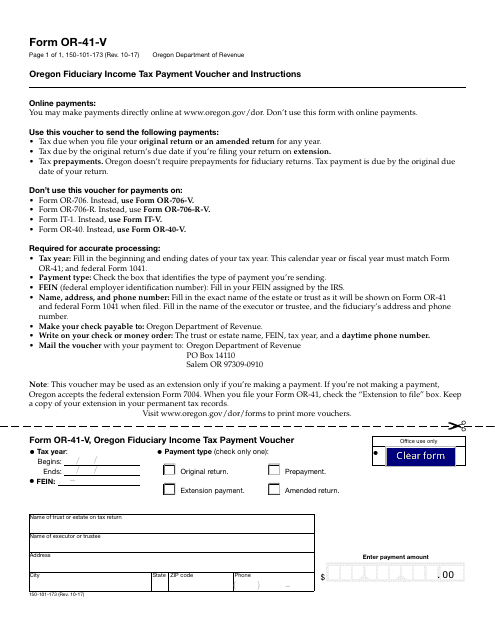

Oregon Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller

Pay the in full amount by November 15 to get the 3 percent discount.

. Individual taxpayers can also postpone state income tax payments for the 2020 tax year due on April 15 to May 17 without penalties and interest regardless of the amount owed. Everything you need to file and pay your Oregon taxes. Annual Use Fuel User - Annual tax less than 10000 as authorized by the department.

4th 10-1 to 12-31 January 20. Oregon residents now have until July 15 2020 to file their state returns and pay any state tax they owe. Vice before October 1 1991 you dont need to make Oregon estimated tax payments on your federal pension.

Estimated tax payments for tax year 2020 are not extended. Reports must be received by the department on or before January 20 for each year. Tax filing and payment due dates for individuals from April 15 2021 to May 17 2021.

If paying in installments the final installment is due May 15. The Oregon Department of Revenue announced late Wednesday March 25 2020 that the state of Oregon will officially extend the deadline for certain tax payments until July 15 2020. Pay the two thirds amount by November 15 to get a 2 percent discount.

Taxpayers must make their second payment for Oregons new Corporate Activity Tax CAT by July 31 2020. To review for the 2020 tax year if you expect a Corporate Activity Tax liability of 10000 or more then you are required to make estimated quarterly payments. If you choose this installment schedule the final one-third payment is due on or before May 15.

July 1 is the beginning of the new fiscal year. Both the IRS and the Oregon Department of Revenue will be providing formal guidance in the coming days. Taxes are due November 15 and may be paid in thirds.

Taxes become payable in October. Form OR-40 OR-40-N and. Last week the IRS delayed tax filing and tax payment deadlines to July 15 without interest or penalties.

Pay what you can by the due date of the return. If you have any questions the tax office is open during regular business hours. Free tax preparation services Learn more.

Skip to the main content of the page. Taxes for 2021 need to be filed by April 18 2022. File your tax return anyway to avoid penalties.

The Oregon Department of Revenue DOR intends to follow guidance from the IRS when more details become available. For 2019 state taxes the state has extended the filing and payment deadline. Property taxes may be paid in installment payments using the following schedules.

This automatic Oregon tax filing and payment deadlines extension incorporates some but not all of the elements of the federal income tax filing and payment deadlines extension. 3rd 7-1 to 9-30 October 20. April 15 July 31 October 31 January 31.

The Oregon Department of Revenue has announced that the state of Oregon will automatically extend the tax filing and payment deadline for individual taxpayers to May 17 2021. Taxpayers that have substantial nexus with Oregon must pay taxes on their Oregon commercial activity. The Internal Revenue Service is pushing back the tax filing deadline by a month.

Lets take a look at a few important dates. Therefore the director has issued Directors Or der 2021-01 ordering an automatic postponement of the 2020 tax year filing and payment dates for individual Oregon taxpayers to May 17 2021. Call us at 503 945-8200 to discuss your debt and options.

Mar 31 2020 0436 PM PDT. KOIN Even though the income tax deadline is postponed until July there are thousands who still have to pay Oregon taxes by April 15. Monday through Friday from 800 am.

The Oregon tax payment deadline for payments due with the 2019 tax year return is automatically extended to July 15 2020. Instructions for personal income and business tax tax forms payment options and tax account look up. Mail a check or money order.

We offer payment plans up to 36 months. Property taxes have a timeline that is different than most other taxes or bills that we pay. The tax year 2019 six-month extension to file if requested continues to extend only the filing deadline until October 15 2020.

Any tax payment with a 2019 Oregon return due by May 15 2020 is automatically extended to July 15 2020. Payment is coordinated through your financial institution and they may charge a fee for this service. Oregon Corporate Activity Tax payment deadline July 31 2020.

Electronic payment from your checking or savings account through the Oregon Tax Payment System. WASHINGTON - Monday is Tax Day 2022 the federal deadline to file income tax returns and pay taxes owed and the IRS expects millions of last. Accordingly the first CAT payment is due April 30 2020.

The Oregon tax payment deadline for payments due with the 2019 tax year return is automatically extended to July 15 2020. The February 1st deadline to make the 4th quarter payment for the Oregon Corporate Activity Tax CAT is coming up on us quickly. As with the federal deadline extension Oregon wont charge interest or apply any penalties on unpaid balances between April 15 and July 15 2020.

Commercial activity generally means a persons or unitary group. If your federal service was both before and after October 1 1991 you may be required to make estimated tax payments based on the portion of your federal pension received for service performed after October 1 1991. Oregon Corporate Activity Tax payment deadline remains April 30.

Oregon Department of Revenue. What are the specific Oregon tax returns for which filing deadlines have been extended to May 17 2021. The Oregon tax payment deadline for payments due with the 2019 tax year return is automatically extended to July 15 2020.

Oregon has not extended the due date of the first payment for its new Corporate Activity Tax CAT. Submit your application by going to Revenue Online and clicking on Apply for ACH credit under Tools. Extend the 2020 estimated tax payments like the IRS did.

The due dates for estimated payments are. Directors Order 2020-01 extended filing and return payment deadlines for personal income tax transit self-employment and fiduciary taxpayers to July 15 2020but. We will continue to monitor the situation closely.

Oregon S Business Alternative Income Tax For Pass Through Entities Jones Roth Cpas Business Advisors

Understanding Your Property Tax Bill Clackamas County

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Prepare Your Oregon State And Irs Income Taxes Now On Efile Com

State Local Tax Impacts Of Covid 19 For Oregon 2021 Bkd

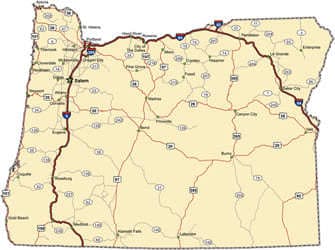

Oregon Ifta Fuel Tax Requirements

Blog Oregon Restaurant Lodging Association

E File Oregon Taxes For A Fast Tax Refund E File Com

List Of State Income Tax Deadlines For 2022 Cpa Practice Advisor

Where S My Oregon State Tax Refund Taxact Blog Tax Refund State Tax Kentucky State

Oregon Standard Promissory Note Template Pdfsimpli

Oregon Property Tax Important Dates Annual Calendar Ticor Northwest